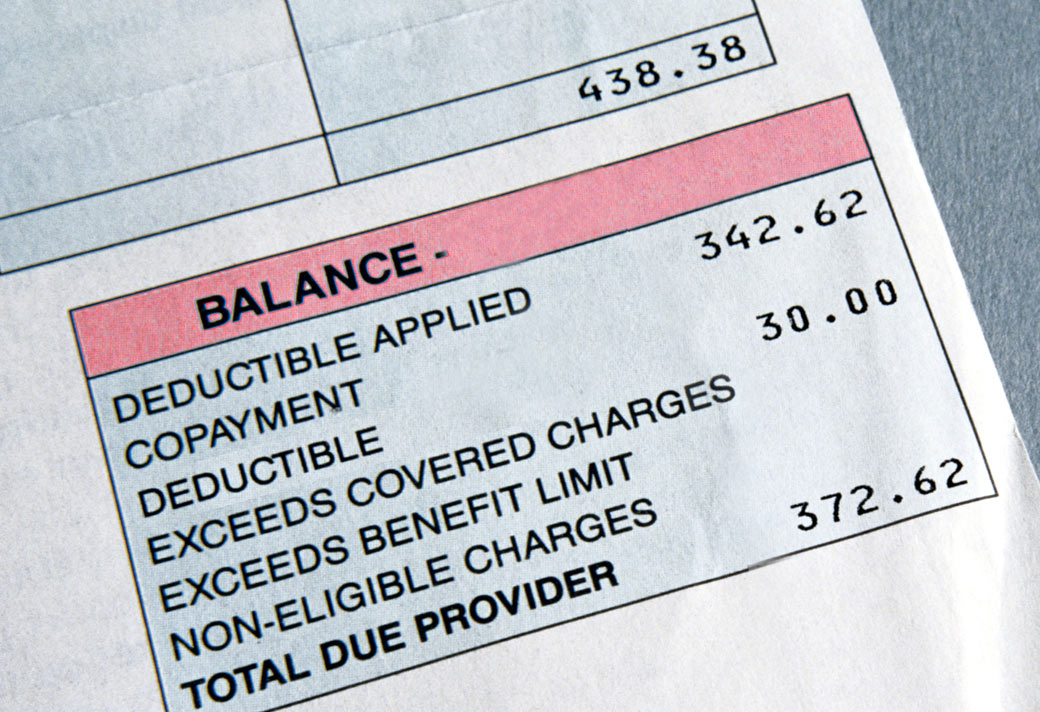

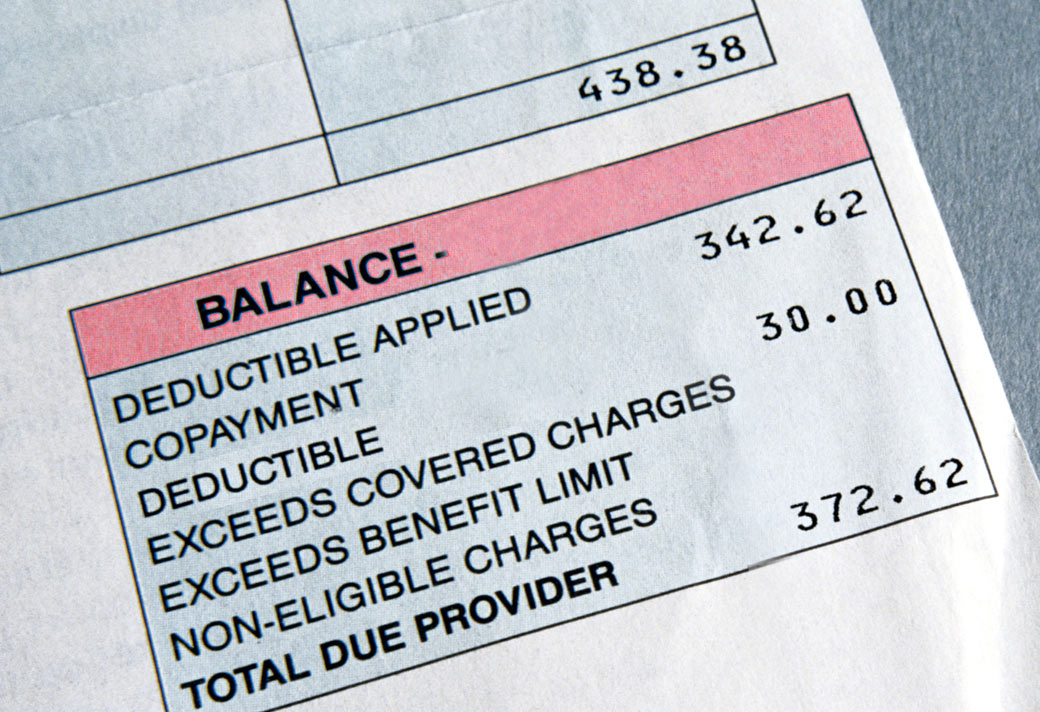

The number one c

omplaint I receive from my clients is “I thought my insurance would pay for _________ ” (fill in the blank). Many people assume that insurance will pay for everything. As an agent I try to educate my clients ahead of time about what their plan does and does not cover but often reality does not sink in until a big bill arrives in the mail. Based on real life situations some of my clients have found themselves in I have developed a list of three questions you should ask each time you visit your doctor if you want to avoid surprises when that bill comes in the mail.

1. Is this test preventive or diagnostic?

After your yearly physical you receive a bill for $500. You thought a yearly physical was preventive and covered at 100%. It is – the physical itself and some of the tests the doctor ran are considered preventive. But many common lab tests (such as vitamin D or thyroid) are diagnostic, not preventive. If you have not met your calendar year deductible you may end up paying 100% of the cost of those tests. To avoid billing surprises request a list of covered preventive procedures from your insurance company and find out how your plan covers diagnostic lab work. Always ask your doctor what tests are being ordered and why. You have the right to decline any test you do not wish to have or pay for.

2. Does this test/procedure require pre-authorization?

Your chiropractor recommends you get an MRI. You go to a stand-alone MRI lab and then submit the bill to your insurance company. They refuse to pay it. You thought MRIs were covered. They are, but only if pre-authorized by the insurance company. Most non-emergency advanced imaging tests and surgeries (think knee or back) require pre-authorization, which brings us to our last question…

3. Are all labs/doctors involved in-network?

You go in for scheduled, pre-authorized surgery. Your surgeon and hospital are in-network (you checked!). Then you get a bill for over $700 from the anesthesiologist. Your insurance company tells you he was out-of-network and that you are responsible for the charge. The hospital says that they are not responsible to make sure each individual doctor is in-network. Once again you must ask questions in advance. If a doctor or lab is out-of-network, ask if an in-network choice is available.

By educating yourself ahead of time and asking questions along the way you will avoid billing surprises. An insurance agent can be an invaluable resource – another great reason to use the services of an insurance professional when choosing and enrolling in a medical plan.

omplaint I receive from my clients is “I thought my insurance would pay for _________ ” (fill in the blank). Many people assume that insurance will pay for everything. As an agent I try to educate my clients ahead of time about what their plan does and does not cover but often reality does not sink in until a big bill arrives in the mail. Based on real life situations some of my clients have found themselves in I have developed a list of three questions you should ask each time you visit your doctor if you want to avoid surprises when that bill comes in the mail.

1. Is this test preventive or diagnostic?

After your yearly physical you receive a bill for $500. You thought a yearly physical was preventive and covered at 100%. It is – the physical itself and some of the tests the doctor ran are considered preventive. But many common lab tests (such as vitamin D or thyroid) are diagnostic, not preventive. If you have not met your calendar year deductible you may end up paying 100% of the cost of those tests. To avoid billing surprises request a list of covered preventive procedures from your insurance company and find out how your plan covers diagnostic lab work. Always ask your doctor what tests are being ordered and why. You have the right to decline any test you do not wish to have or pay for.

2. Does this test/procedure require pre-authorization?

Your chiropractor recommends you get an MRI. You go to a stand-alone MRI lab and then submit the bill to your insurance company. They refuse to pay it. You thought MRIs were covered. They are, but only if pre-authorized by the insurance company. Most non-emergency advanced imaging tests and surgeries (think knee or back) require pre-authorization, which brings us to our last question…

3. Are all labs/doctors involved in-network?

You go in for scheduled, pre-authorized surgery. Your surgeon and hospital are in-network (you checked!). Then you get a bill for over $700 from the anesthesiologist. Your insurance company tells you he was out-of-network and that you are responsible for the charge. The hospital says that they are not responsible to make sure each individual doctor is in-network. Once again you must ask questions in advance. If a doctor or lab is out-of-network, ask if an in-network choice is available.

By educating yourself ahead of time and asking questions along the way you will avoid billing surprises. An insurance agent can be an invaluable resource – another great reason to use the services of an insurance professional when choosing and enrolling in a medical plan.

omplaint I receive from my clients is “I thought my insurance would pay for _________ ” (fill in the blank). Many people assume that insurance will pay for everything. As an agent I try to educate my clients ahead of time about what their plan does and does not cover but often reality does not sink in until a big bill arrives in the mail. Based on real life situations some of my clients have found themselves in I have developed a list of three questions you should ask each time you visit your doctor if you want to avoid surprises when that bill comes in the mail.

1. Is this test preventive or diagnostic?

After your yearly physical you receive a bill for $500. You thought a yearly physical was preventive and covered at 100%. It is – the physical itself and some of the tests the doctor ran are considered preventive. But many common lab tests (such as vitamin D or thyroid) are diagnostic, not preventive. If you have not met your calendar year deductible you may end up paying 100% of the cost of those tests. To avoid billing surprises request a list of covered preventive procedures from your insurance company and find out how your plan covers diagnostic lab work. Always ask your doctor what tests are being ordered and why. You have the right to decline any test you do not wish to have or pay for.

2. Does this test/procedure require pre-authorization?

Your chiropractor recommends you get an MRI. You go to a stand-alone MRI lab and then submit the bill to your insurance company. They refuse to pay it. You thought MRIs were covered. They are, but only if pre-authorized by the insurance company. Most non-emergency advanced imaging tests and surgeries (think knee or back) require pre-authorization, which brings us to our last question…

3. Are all labs/doctors involved in-network?

You go in for scheduled, pre-authorized surgery. Your surgeon and hospital are in-network (you checked!). Then you get a bill for over $700 from the anesthesiologist. Your insurance company tells you he was out-of-network and that you are responsible for the charge. The hospital says that they are not responsible to make sure each individual doctor is in-network. Once again you must ask questions in advance. If a doctor or lab is out-of-network, ask if an in-network choice is available.

By educating yourself ahead of time and asking questions along the way you will avoid billing surprises. An insurance agent can be an invaluable resource – another great reason to use the services of an insurance professional when choosing and enrolling in a medical plan.